Access To Over 100+ specialty Florida Mortgage Lenders!

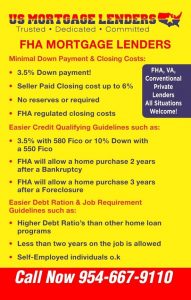

Florida FHA Mortgage Lenders Purchase or Refinance!

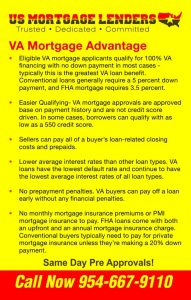

Florida VA Mortgage Lenders Purchase or Refinance!

Florida VA Mortgage Lenders Purchase or Refinance! Florida Bank Statement Mortgage Lenders Purchase or Refinance!

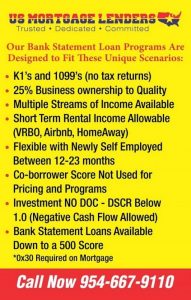

Florida Bank Statement Mortgage Lenders Purchase or Refinance!

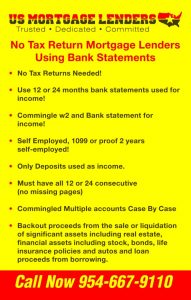

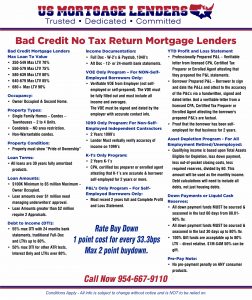

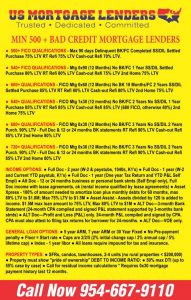

Florida No Tax Return Mortgage lenders Purchase or Refinance!

Florida No Tax Return Mortgage lenders Purchase or Refinance!

Bad Credit Florida No Tax Return Mortgage Lenders

Florida 1099s For Income Florida Mortgage lenders Purchase or Refinance!

Florida Bad Credit Mortgage Lenders Purchase or Refinance!

No Income Verification Florida Mortgage!